Insurance News Articles

We try to answer your questions before you ask them. If you ever have any questions, please contact us. We are always here for you!

How To Save Money On Your Current Insurance Policy

Joe Rothpearl

When you know what to look for, saving money on your Auto or Home Insurance is easy. Eastway has been looking at New York Insurance since 1983 and I've been a Licensed Agent for over 20 years. You won't find a more Independent Agent or Agency in New York.

Let me know if you want us to take a look at your current coverage to see what you could save! You can reply to this email. If you have any family or friends who could benefit from saving money on home & auto insurance please forward this email to them too.

We are driven to help others and appreciate your help meeting new people. Please leave us a 5 Star review on Google!

PLEASE CLICK HERE TO LEAVE A GOOGLE REVIEW

Saving money on your Auto and Home insurance starts with a free quote. All you need to start is a copy of your current declarations page and driver's license. We can explain what you are paying for and why it costs what it does. Only an Independent, Family-Owned Agency will treat you the way we do. Call (585) 586-2390, reply to this email or stop in for a free quote today. Since 1983 we have been helping our neighbors, friends and family save money.

moreWe Appreciate You!

Joe Rothpearl

Our family wants to say Thank You Very Much for being a part of our success. We are grateful for the trust you have placed in us and we are dedicated to help you succeed as well. Please reach out to us if you ever have any questions or concerns. You can reply to this email. If you have any family or friends who could benefit from saving money on home & auto insurance please forward this email to them too.

We are driven to help others and appreciate your help meeting new people. Please leave us a 5 Star review on Google!

PLEASE CLICK HERE TO LEAVE A GOOGLE REVIEW

Saving money on your Auto and Home insurance starts with a free quote. All you need to start is a copy of your current declarations page and driver's license. We can explain what you are paying for and why it costs what it does. Only an Independent, Family-Owned Agency will treat you the way we do. Call (585) 586-2390, reply to this email or stop in for a free quote today. Since 1983 we have been helping our neighbors, friends and family save money.

moreSaving Money on Your Insurance

Save money on your Auto and Home Insurance and Start Today with a free quote.

Only an Independent, Family-Owned Agency will treat you the way we do. Help us celebrate our forty-third year in Penfield and call, email or stop in for a free quote today. Let us help make your life richer!! Contact 585 5862390 joe@eastwayinsuranceagency.com for your free quote today. Please locate your existing policy so we can validate your current coverage for a more accurate comparison.

moreNYS Rate Increases

Josef Rothpearl

Have you considered switching your current coverage? We can help you validate the premium you are paying. Saving you money does not always require a new policy and our primary goal is to help you save. We can quote multiple companies as well as explain what you are paying for and how it compares in coverages. If you are a small business owner we can quote you too!

Please click here to give us a Google Review!

As an Independent Agency, Eastway can offer many insurance companies, allowing us to shop for the best coverage and lowest rates. If you have questions about Auto, Home, Life or Health Insurance we will go out of our way to answer you. We are immensely proud to celebrate our 40th year supporting our community. Founded by the late Patrick Saulino in 1983, we are family owned and operated and we love what we do! We have helped thousands of people save money and this motivates us to help more. We get excited when we can be a part of making life easier for anyone. The right attitude can make a lifetime of difference.

Please reach out to us by email: answers@eastwayinsuranceagency.com or by call (585) 586-2390 and we will go out of our way to help you.

moreCelebrating Forty Years

All of us at Eastway are very excited to celebrate our fortieth year helping Rochester save money and live better. We have partnered with our neighbors at Flower Barn and Rosey's Italian Cafe to give you a gift!

Save money on your Auto and Home Insurance now and Start Today with a $10 coupon good at Flower Barn or Rosey's Italian Cafe! Come in for a free quote and get $10 off your Total Purchase.

Only an Independent, Family-Owned Agency will treat you the way we do. Help us celebrate our fortieth year in Penfield and call, email or stop in for a free quote today. Let us help make your life richer!! Contact joe@eastwayinsuranceagency.com for your free quote today. Please locate your existing policy so we can validate your current coverage for a more accurate comparison.

Offer runs from July 1st – July 31st, 2023. No Purchase Necessary

moreThe Greatest Gift

Joe Rothpearl

Life Is The Greatest Gift You Can Give. It can also be the greatest gift you receive. I know because I received this gift. I had a catastrophic injury to my cervical spine and donor bone is the reason I can walk and talk today. Without the Gift of Life, I would have been a quadriplegic on a ventilator. My name is Joe Rothpearl. I am a donor recipient and a Proud Partner with Donate Life New York State (Click to Register Here!!!)

moreSave A Bundle

Joe Rothpearl

What gets us excited at Eastway? We get excited when we can save people money. In fact, we go out of our way to help people save money. When you come to us for a quote, we don’t charge anything to help you find the best rate and coverage. Every one of our Auto and Home policyholders saved money by working with us.

How easy is it to save money? Saving money is just as easy as getting a new quote. A quote starts with basic information and there are also a lot of questions to answer. If you are not getting asked a lot of questions, there’s a good chance you don’t have the right price or suitable coverage. It’s always a good idea to get a quote every year before your premium renews so you can make sure your coverage fits your needs.

What information should you have ready for a quote? The most important information is your Driver’s License (Name, Address, Date of Birth), email address, phone number, vehicle information number (VIN#), and any driving history that may affect your quote.

What about bundling? Bundling is a catchphrase word that you’ll hear it a lot in advertisements. I heard one on my way into my work this morning and it’s not a bad thing. It requires having more than one policy, such as your Auto and Home insurance, ‘bundled’ together in one package. It also means you are going to save money. With just one policy you will receive a discount that you would not otherwise be eligible for. The savings could be hundreds of dollars to a thousand dollars or more. More? Absolutely. It depends on your specific coverage. If your policies are not bundled together currently, or they are with different insurance companies, you could save a bundle!

moreAuto And Home Insurance Is Going Up

Jeremy Rothpearl

Auto and Home Insurance is going up nationally and especially in New York State. If you have a lapse in auto insurance coverage it will be extremely difficult to secure affordable coverage and in some cases any coverage at all. Most insurance companies require you to have current insurance in place before switching to another carrier. If you do not currently have insurance, you will be denied by most companies.

How did this happen? There are a lot of answers, but the main reason is cost effectiveness. Insurance companies lose money from bad risks and the less bad risks they insure – the more profitable they are. You will be seen as a bad risk if you do not currently have insurance coverage for the last year or two. Some insurance carriers will charge a higher premium if your coverage was cancelled or lapsed. That is if they can underwrite you at all.

If you get a cancellation notice from your insurance company, Do Not Ignore this Letter!!! Your best option is to try to keep your existing coverage. Contact them and ask if you can stay by making a payment (and late fee if any). Your immediate next step is to start looking for other coverage. Remember you need to have coverage in order to change your coverage.

moreWhat does Joe Namath know about your benefits?

Joe Rothpearl

If You Guessed ‘nothing’ then you are correct! Insurance is confusing enough without former athletes and stars advising us about our benefits. Regardless of what type of insurance you have - the television commercials always promote the slightest possibilities to the widest audience. A call center operator cannot appreciate your personal needs after spending minutes on the phone with you.

Eastway Insurance Agency has been an Independent, Family Owned, Local Agency since 1983. We do not advertise on television or in the newspaper and most of our clients are referrals. We do not charge to review your insurance and we do not receive a commission for advising you. It costs you nothing to review your coverage with us and you could potentially save money with the knowledge you gain. Everyone is different and every plan does not fit everybody. Let’s talk about what works for you!

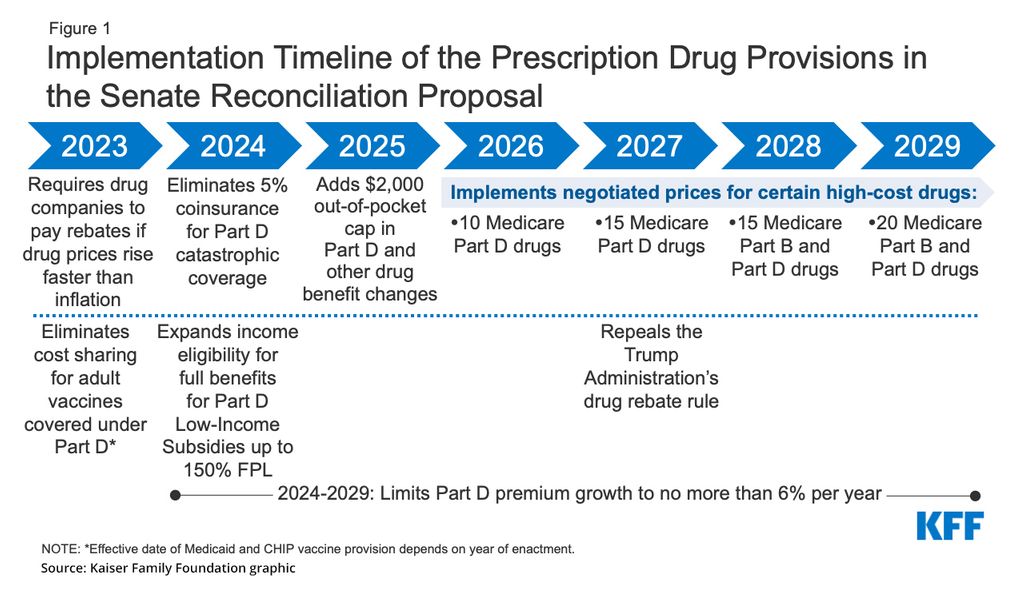

moreWhat the Inflation Reduction Act of 2022 Means for Medicare

Joe Rothpearl

The Inflation Reduction Act of 2022 has been signed into law. Much has been said about the environmental and economic aspects, but what it’s proposed to do for Medicare could surely have a big impact on the industry.

Congress passed the Inflation Reduction Act (IRA) of 2022, which is set to be signed into law today. This government reconciliation bill promises to fund environmental efforts, close tax loopholes, work to lower inflation, and reduce health care costs under Medicare. The changes this bill brings has the potential to save Medicare beneficiaries thousands of dollars annually.

Unless directly cited elsewhere, all facts and figures from the bill can be found directly in the legislative text of the Inflation Reduction Act of 2022 or the topline messages for the drug pricing reforms.

moreWhat is Inflammation?

Jeremy Rothpearl

What is Inflammation?

There are a lot of products and diets out there that promise to combat inflammation, but what does that mean? What is inflammation? What causes it, and how does it influence our health?

Inflammation is one of those health industry buzzwords that you see often, but it’s never really defined. So often, it’s tied to some product that promises to reduce inflammation, with a tagline that inflammation is the leading cause of some scary-sounding condition. It may surprise you that inflammation is a natural occurrence for our bodies. While inflammation can have health detriments and chronic inflammation can influence or lead to certain illnesses or conditions, you can’t eliminate inflammation entirely. So, to show you that we don’t have to fear a little inflammation and that it can be controlled, let’s explore exactly what it is, how it can influence your health, and how you can control it. Once we understand inflammation, it’s not as scary.

What Is Inflammation?

As we hinted at earlier, inflammation occurs naturally in the body as an immune response. There are generally two kinds of inflammation that we may experience, acute and chronic. Acute inflammation is a short-lived bout that lasts anywhere from a few hours to a few days. Chronic inflammation may last longer, sometimes from months to years. While both can have symptoms, it’s chronic inflammation that can lead to health complications. More on that later.

moreDoes Medicare Cover Respite Care?

Joe Rothpearl

Does Medicare Cover Respite Care?

Being a caregiver for a loved one receiving hospice care can be difficult. Respite care can give you a chance to rest and recharge, but does Medicare cover it?

We all need a little rest from time to time, but for those who act as primary caregivers for their loved ones, rest may be difficult to come by. It may be even more elusive if your loved one has a critical condition that requires constant supervision and care.

Respite care can help caregivers find some relief. Of course, any kind of specialized care will cost money, but will Medicare help pay for respite care?

What is Respite Care?

Respite care, in essence, is a service that takes some of the responsibility of care off caregivers. After all, caring for someone who needs assistance with daily tasks, medical interventions, or supervision can be both a physically and emotionally draining responsibility, especially if it’s part of a hospice care program, when the loved one isn’t expected to survive their diagnosis. Caregivers may need short times of relief to avoid burnout and health issues themselves.

moreYour Guide To The Medicare Annual Enrollment Period

Carmen Fantauzzi

Get ready for the Medicare Annual Enrollment Period with our centralized guide to AEP.

Medicare’s Annual Enrollment Period (AEP) is right around the corner! Every year, the AEP is your opportunity to enroll in or switch to a Medicare plan that fits your ever evolving health care needs. This special enrollment window only runs October 15 to December 7, so it’s important to be prepared to accomplish anything you’d like to during that time. If reviewing or changing your coverage seems a little daunting with all the different plans and benefits on the market and decisions to make, don’t worry! You don’t have to go it alone.

Over the years, we’ve covered a lot of Medicare topics. To help you find what you need to know fast, we’re putting the most relevant information and article links below. That’s it. No fuss, just direct links to the information that can help you find your next Medicare plan! We’ll be sure to update this article as we publish new content that we think you’ll find helpful.

Medicareful Plan Finder

When you’re entering AEP, a great place to start for any Medicare plan search is the Medicareful Plan Finder. You can search and compare different types of Medicare plans directly on the platform, share plan information, and get in touch with a licensed insurance agent for further assistance. Working with a Medicareful agent is doubly beneficial, as they’ll have access to tools like the account feature.

moreWhat You Need To Know Before You Go To A Plan Sponsored Event

Joe Rothpearl

What you need to know before going to a plan sponsored event or seminar.

Have you been invited to a Medicare seminar by one of the top insurance providers? Maybe your own insurance provider has invited you to a free, no-obligation Medicare event near you? This is what you must know before you go to that meeting.

Insurance company sponsored events can be informative. The problem is that they will only inform you about their plan, the plan they want you to purchase. What they won’t tell you is anything about all the other major insurance providers and plans in your area and in your network. They won’t help you compare their plan to any other companies plans. They won’t do a comparison on what your drugs would cost on other plans aside from their own. Because they only want you to go with their plan.

At Eastway we know that the only way for you to choose a plan is to have a fair comparison of all the plans available to you. We know because we provide our clients, friends, and family members with comprehensive comparisons from all the plans available. We are contracted with most companies in New York State, and we are not biased to favor one over another. We favor you and what suits your needs. We also research and help you with any insurance companies plans and not just the ones we choose to contract with.

moreWhat are the Medicare Part D Defined Standard Benefits and Alternatives?

Joe Rothpearl

There are a number of factors that designate what Medicare Part D plans can offer beneficiaries. While defined standard benefits set the bar, the other factors of Part D coverage can influence what you pay out of pocket.

Purchasing Medicare Part D is something that’s important to consider for anyone who is enrolled in Original Medicare. These privately offered plans cover many of the important prescription drugs and medications that can be an essential facet in a treatment plan, whether they be for heart health maintenance or treatment for chronic conditions. Since the plans are offered by private companies as part of the Medicare program, the Centers for Medicare & Medicaid Services (CMS) sets some standards so that each plan maintains the expectations that are anticipated by beneficiaries. For this reason, there are two general plans with four subcategories that you may see when exploring Medicare Part D plans. These subcategories are often identified by abbreviations, which we cover below. Considering the amount of details you should compare when searching for a Part D plan, understanding these designations, and what they mean for your plan, can go a long way toward simplifying the entire process.

moreWe always put the needs of our clients and potential clients first

Carmen Fantauzzi

We always put the needs of our clients and potential clients first. Today I was asked to write a new plan for a potential client and most agents would have done so without hesitation. However this would not have been in the best interest of this specific individual. I did not leave with a sale but I did leave with another new friend and that is a kind of profit you can’t put a price on.

We value doing what is right more than any potential commission and it is this level of dedication to service we expect of ourselves. There are not many agents or agencies still around who will advise you to ‘stick with the plan you have’. Eastway Insurance Agency has been educating New Yorkers on Medicare Health Plan Benefits/Options and Life Insurance for over thirty five years. Please contact us for your insurance review with no fee to talk about all plans available to you.

Eastway Insurance Agency has been answering Medicare A&B questions since 1985. We are a family owned and operated Life & Health insurance agency and have helped thousands with their Medicare A&B Health & Life Insurance decisions. Please contact us for your personalized assistance. We can help you too! Email: answers@eastwayinsuranceagency.com Call: (585) 586-2390 or 1(800) 836-9071

moreDon't panic when you get a medical bill.

Jeremy Rothpearl

Don't panic when you get a medical bill. Make sure you are paying the right amount and not more than you should be.

Eastway Insurance Agency has been answering Medicare A&B questions since 1985. We are a family owned and operated Life & Health insurance agency and have helped thousands with their Medicare A&B Health Insurance decisions. Please contact us for your personalized assistance. We can help you too! Email: answers@eastwayinsuranceagency.com Call: (585) 586-2390 or 1(800) 836-9071

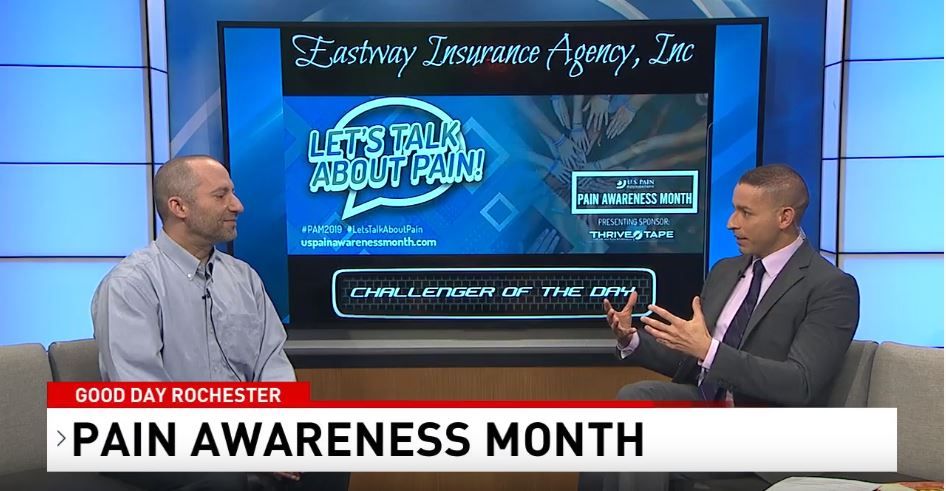

moreGood Day Rochester National Pain Awareness Month USPainfoundation.org

Eastway Insurance Agency's Vice President Joe Rothpearl appears on Good Day Rochester, on 13WHAM Fox Rochester 9/30/19, for Pain Awareness Month and USPainfoundation.org

Eastway Insurance Agency has been answering Medicare A&B questions since 1985. Eastway Insurance Agency, Inc. is a family owned and operated Life&Health insurance agency. We have helped thousands with their Medicare A&B Health Insurance decisions. Please contact us for your personalized assistance. We can help you too!

Email: answers@eastwayinsuranceagency.com

Call: (585) 586-2390 1(800) 836-9071 We specialize in Medicare Health insurance.

moreHow can the Insurance Provider know what Medicare Plan is right for me?

Eastway Insurance Agency, Inc.

TV ads for Medicare Health Insurance don't know you as well as you think. Be your own Advocate and choose the plan that suits your unique needs. This is a Message for Medicare A&B Recipients (+65 and/or Disabled). We can't tell you what plan will work for you without knowing you. Let's get to know each other soon!

moreFCC Warning About Medicare Phone Scams

Josef Rothpearl

Please be aware of this disturbing trend in Medicare related scams. We are CMS Compliant and do not use any of the scary tactics described in the FCC article below. We will not call you if we do not already know you. We will not push you to purchase anything ever. We do not use fear to motivate you. We will educate you on your options and help find advantages unique to your needs. We will help you enroll in the plan you choose. We will also advise you to stick with your current plan if it is in your best interest. Since 1985 we are an Independent Family-Owned Life & Health Insurance Agency. We have helped thousands of people make this decision and we can help you too!

Please contact us via email, telephone, or through our Contact Form : https://eastwayinsuranceagency.com/request-a-quote

FCC article: https://www.fcc.gov/older-americans-and-medicare-card-scams

moreI was told they don't accept my Health Insurance

Jeremy Rothpearl & Josef Rothpearl

The book 1984 written by George Orwell in 1948 drew a picture of a future Society where misinformation, fake news, and propaganda are used to control people. Misinformation is rampant today and not only on the news and social media sites either. We have had many complaints from clients saying they called the Hospital/Provider/Lab/Billing Department/Dr. Office and were told ‘they don’t take my Insurance’. We call the same numbers and often times they admit to us that they accept the clients plan.

Medicare Supplemental plans are secondary plans that work together with Medicare as the primary coverage. The client is covered in full as long as it medically necessary and the provider accepts Medicare. Medicare Advantage plans also work with Medicare but as the primary coverage. Many companies, Like United Health Care, have Medicare Advantage Plans and Medicare Supplement Plans. We help others understand the clear differences and benefits they both can provide.

Is it bad training, lack of training or caring, a misunderstanding between what is a Medicare Advantage Plan and what is a Medicare Supplemental plan? Most of the times it is the mention of UHC (United Health Care) by the client to the person on the phone that has the office worker respond with “that insurance company is not accepted”. On the contrary, we see that some insurance companies may be accepted as out of network vs. in network and may cost the client more in co-pays to go there. Sometimes, especially with HMO plans that by design have network coverage only, it is true that they may not be accepted. Other times it is the Brand name confusion of the insurance company. For example; while UHC Medicare advantage plan may not be in-network it could be out-of-network. The provider who doesn’t accept the Medicare Advantage plan in-network would still accept the no-network Medicare Supplement. The provider who accepts Medicare will accept the Medicare supplemental plan.

moreAre you seeing Red?

Jeremy Rothpearl

A lot of Medicare Supplement owners pay more than others for the same plan. By law all plans must provide the same benefits - just not at the same cost. It's not apples an oranges either. It's the same apple with a different label. If you are seeing red with your health insurance costs it may be that you are paying more than you need to. A Health Insurance Review can help to better understand your health care cost and save you more than money. Their is no obligation and no better time than this moment.

Take a look at this link from New York State Department of Financial Services and let us know what you think!

https://www.dfs.ny.gov/consumers/health_insurance/supplement_plans_rates/comparisons/plan_f

moreLife Insurance is about peace of mind.

Eastway Insurance Agency, Inc.

Life Insurance is about peace of mind. In order for Life Insurance to provide peace of mind it must be affordable and easy to understand. We will work to help you easily afford peace of mind. Please contact us with your questions today.

moreWill My Medicare Supplement Plan Cover Physical Therapy Treatments

Jeremy Rothpearl

Below is a recent email we received from a client needing physical therapy and our reply. Please send us in your questions via email, Facebook or through our Website. We want to answer Your questions!

“Dear Jeremy, My PCP wants me to have some therapy, will my Medicare Supplement Insurance cover it and, how do we find out how many treatments it \ will pay for ( 1, 2 ,3 ,4..)?

Thank you in advance my good man as always for answering my questions and lowering my stress. – Chuck"

Dear Chuck,

Your question is actually addressed and answered by Medicare - which is your primary insurance. The insurance is secondary and follows all the rules and regulations set by Medicare. The Doctor, Service Provider and Medicare may be able to answer how many initial visits are covered. Also, at any time, you may call your insurance company to ask any questions. The answer is: there are limits and caps on monetary values related to therapy coverage. Your Dr. may expand those caps as long as the ongoing therapy is medically reasonable and necessary services.

On the Medicare website, https://www.medicare.gov/coverage/speech-language-pathology-services you can find the complete explanation (also printed out in full below). At the end of the answer it states:

moreYou Can't Put A Price On Piece Of Mind

Joe Rothpearl

It’s not always about the sale, as in the case with Mr. & Mrs. M.

She was so elated that I was able to help provide both of them with affordable insurance coverage, she said 'now we can sleep at night knowing that we are taken care of'. Hearing this from her brought me personal satisfaction knowing that I was able to help this couple in a way no one else was able to do and or didn’t have the patience to do.

It is great when our clients let us know how elated they are that we were able to provide them with affordable insurance coverage. They say ‘now we can sleep at night knowing that we are taken care of’, and hearing this is our sign of Success. Satisfaction comes with knowing that we were able to help people in a way that no one else was able to do or did not have the time and patience to do. You can’t put a price on peace of mind.

moreEliminate Unforeseen Financial Debt With Life Insurance

Jeremy Rothpearl

Life Insurance Is An Affordable Solution To Eliminate The Concern Of Unforeseen Financial Debt

Request A Life Insurance Quote Today

Emily is twenty-three years old, graduated College in May 2016, and has $38,000 in student loans with her mother as the co-signor on the loans. Recently two of Emily’s friends were killed in a tragic car accident. Emily is very concerned that if she died her Mother would be stuck having to pay back her student loans. Emily has a valid concern. When a person cosigns on a loan, in the event of a death, the cosigner is legally responsible for paying the loan. Life Insurance is an affordable solution to eliminate Emily’s concern of not wanting to burden her mother with financial debt.

After speaking with me Emily was eager to learn more about the different types of Life Insurance available, how they differ and how they are priced to fit in her budget. I want to share with you some of what we discussed. I gave a very detailed description and explanation of the three main Life Insurance types during our conversation. I will explain them here in brief.

moreMy Bank Is Always Asking Me To Sign Up For Life Insurance

Eastway Insurance Agency, Inc.

My bank is always asking me to sit down and sign up for Life Insurance from them. Is this a good thing for me?

Most banks are always looking to increase their revenue with fees and ‘value-added products’ for sale. The bank will usually have one company they represent. We call this the Red option. The Red option may not be the best fit for all people as the premiums may be higher for some and as a captive client of the bank this could be the only option offered to you. An important question you should ask is: do other options exist for me and are the other options a richer fit for my needs based on my health and budget?

moreWhat Makes Us Unique

Josef Rothpearl

What makes us unique is simply being honest. We approach each client, situation, question, problem, issue and each new day with complete honesty. We sit down with people to go over their needs, situation and their issues. We answer their questions in a relaxed atmosphere where the pressure to buy is replaced with the opportunity to learn. This is our niche and why we have been in business for over thirty years: as time goes on just being honest is becoming rare.

Most know that nothing is free and if it says it's free there is a cost somewhere along the line. Some people like to put a spin on things to make them sound better. Some companies offer free gifts to ‘sign up’ with them. True Personal Service is the only free gift our Agents offer.

Our Agents can come and visit you for free and provide you an opportunity to voice your thoughts and ask questions. The only cost is if you decide to purchase a policy and the cost of that policy will not change because you purchased it through us. The only thing that does change is this: if and when you have a question, or a problem, or a claim, or an issue, you will have us to call to get an honest answer from.

more